Incremental Is Incremental Revenues Minus Incremental Costs.

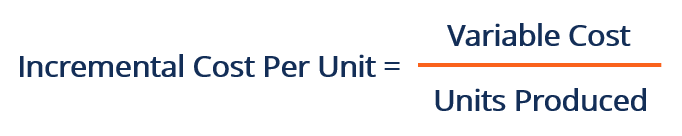

Incremental costs may include more than the change in variable costs. Determine the price of each unit sold during a period of growth.

Incremental Revenue Definition Formula Calculation With Examples

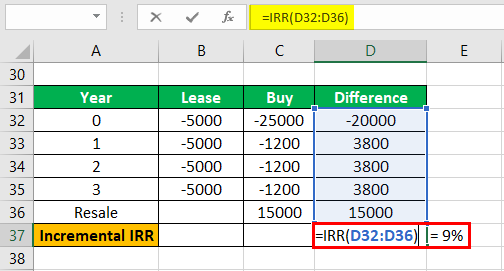

Total revenue minus total cost Marginalincremental revenue.

. Your incremental revenue equals 20000. And 3 find earnings and rates of return on incremental investments. Hereof Which of the following is an.

When you compare the two it is clear that the incremental revenue is higher than the incremental cost. Incremental or differential costs are___ costs in making decisions. Producing output and then adjusting price to.

So take your new sales 95000 and subtract your baseline sales 75000. Incremental Operating Costs means the incremental expenses incurred by the Recipients implementing agencies on account of Project implementation management and monitoring including office space rental utilities and supplies bank charges communications advertising vehicle operation maintenance and insurance building and equipment maintenance costs. Incremental Revenue means the actual accumulated Relevant Revenue received by the Relevant Businesses for each of the Installment Periods in accordance with US GAAP over and above US6 million in the case of the First Installment Period and in the case of Second Installment Period and the Third Installment Period the Accumulated Revenue for the Installment Period in.

10 Incremental Investments. Your incremental revenue equals your new sales minus your baseline sales IR NS BS. The concept is used in the following situations.

Provide a business example for each of these terms. 2 understand how time and use costs determine the optimal service extraction rate from investments. By subtracting the incremental cost from the incremental revenue you.

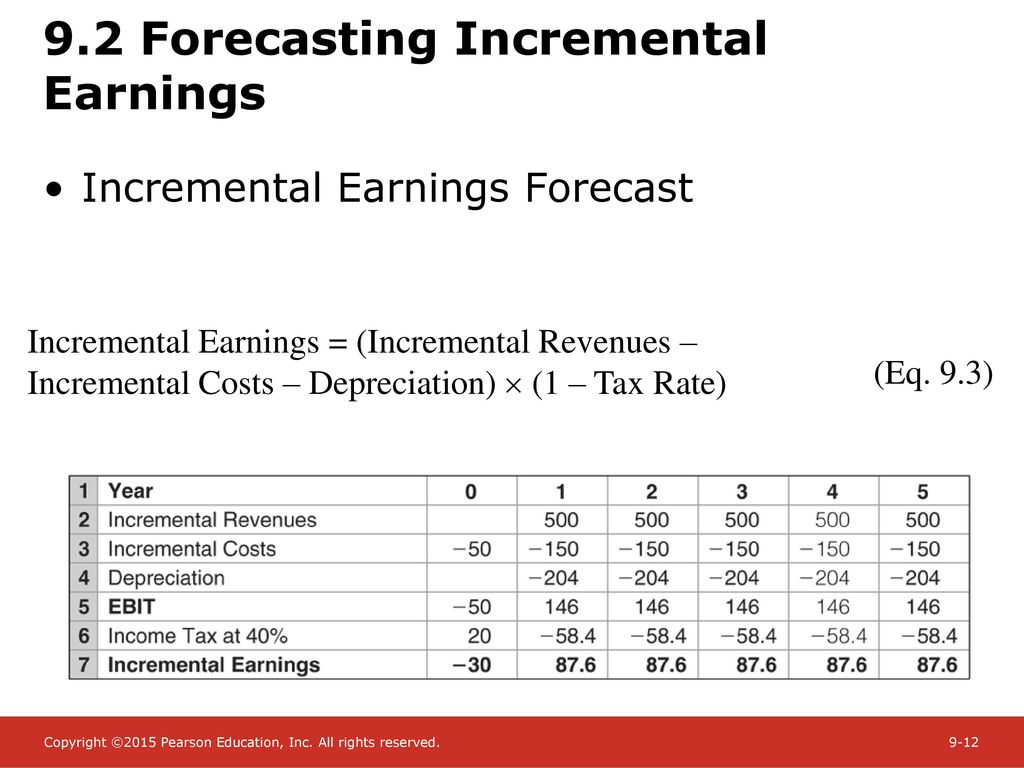

Dailys marginal tax rate is 35. Continuing with the example if the incremental sales over a five-year period are 2 million the incremental operating expenses are 1 million and depreciation expenses are 500000 then. The machine will generate incremental revenues of 4 million per year along with incremental costs of 12 million per year.

The calculation of incremental revenue involves establishing a baseline revenue level and then measuring changes from that point. Incremental costs are also referred to as the differential costs and they may be the relevant costs for certain short run decisions involving two alternatives. The cost of producing an additional unit of output Return on equity.

Therefore the incremental free cash flows associated with the new machine is calculated as follows. Provide a business example for each of these terms. A fixed building lease for example does not change in price when you increase production.

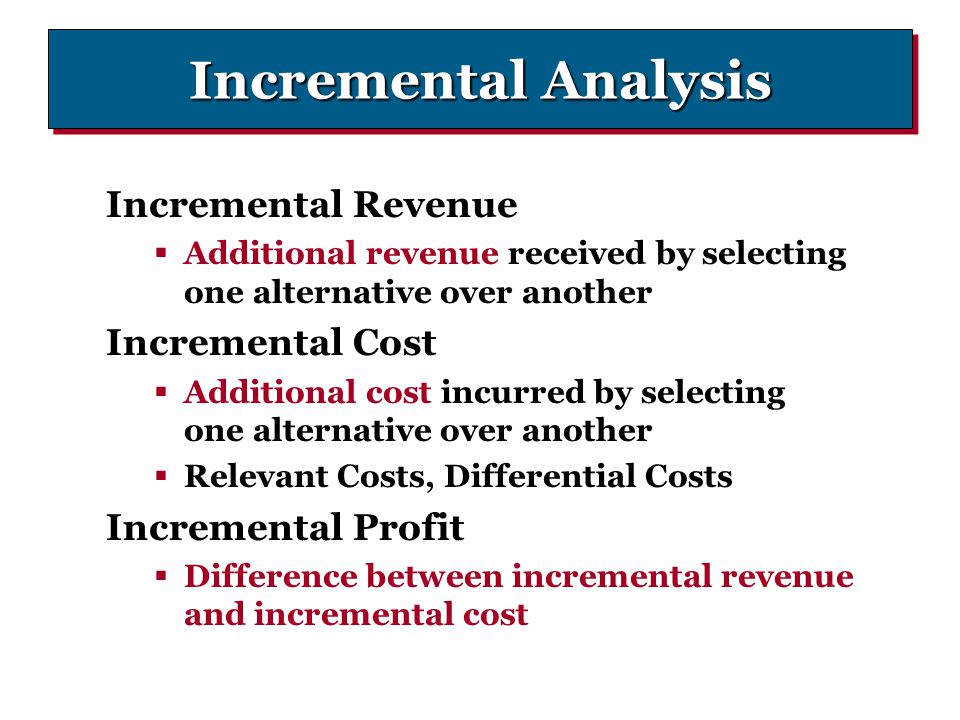

Profits divided by shareholder equity Producing to stock. Incremental_____is incremental revenues minus incremental costs. Incremental Analysis Explain incremental revenues and incremental costs.

So take your new sales 95000 and subtract your baseline sales 75000. The revenue from selling an additional unit of output Marginal incremental cost. The top line on the income statement.

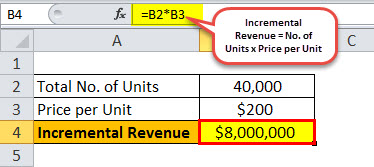

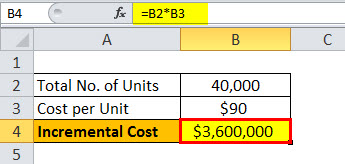

Multiply the number of units by the price per unit. 2000 40 per chair Overhead expenses do not increase. Determine the number of units sold during a period of growth.

Incremental Analysis Explain incremental revenues and incremental costs. So incremental revenue is 6000000. Adding the materials and labor together you have a total cost of 4000 and so your incremental margin for these extra chairs is 1000 or 20.

Your incremental revenue equals your new sales minus your baseline sales IR NS BS. 5000 each month 100 per chair Materials cost 2000 40 per chair Labor cost. Incremental costs help to determine the profit maximization point for a company or when marginal costs equal marginal revenues.

1 distinguish between incremental and stand-alone investments. Chapter 11 Summary Chapter Terms Profits. Similarly any firm that adds a standard allocated charge for fixed costs and overhead to the true incremental cost of production runs the risk of turning down profitable business.

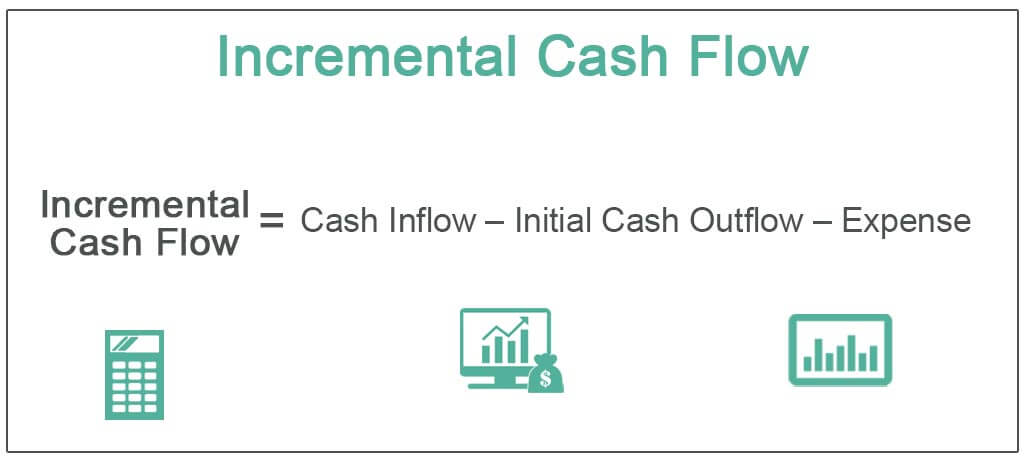

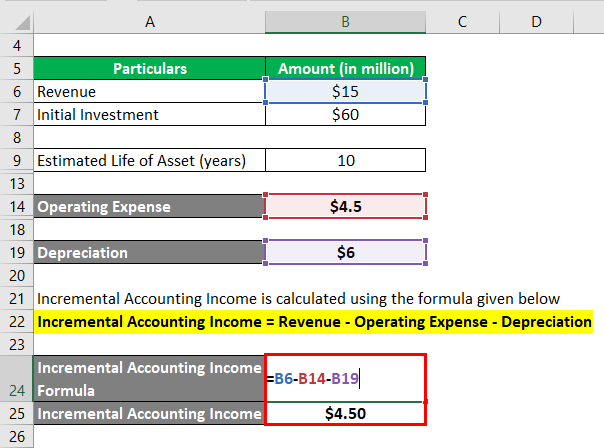

Incremental Free Cash Flows. Incremental Earnings Incremental Revenue - Incremental Costs - Depreciation 1 - Marginal Tax Rate 4000000 - 12000000 -2010000 1 - 35 513500. Incremental earnings equals the after-tax value of Incremental Revenues minus Incremental Costs and Depreciation.

Incremental Cost vs. Your incremental revenue equals 20000. Earnings revenues - Costs - Depreciation 1 - Tax Rate -Revenue.

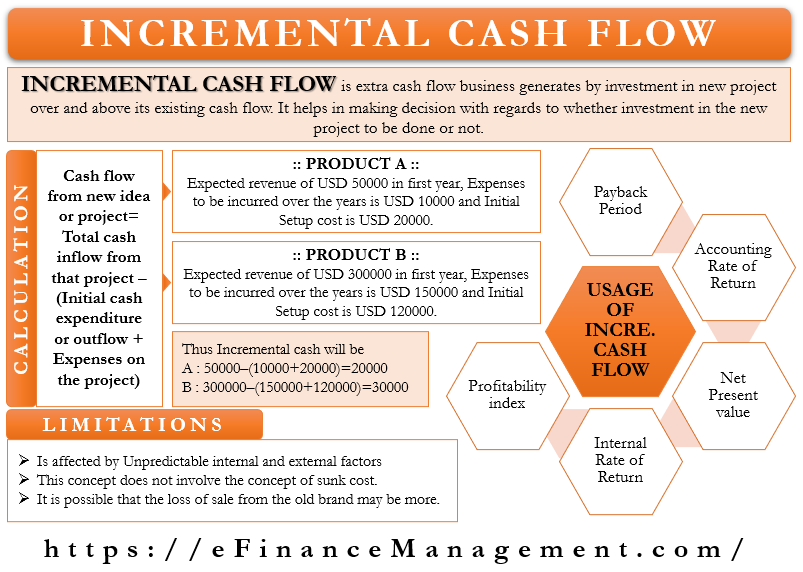

How to calculate incremental revenue. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. Even though Line B generates more revenue than Line A its resulting incremental cash flow is 5000 less than Line As due to its larger expenses and initial investment.

The unit net income is 060 and the special order will generate an incremental net income of 1800 3000 x 060. So you will have. Your incremental revenue equals your new sales minus your baseline sales IR NS BS.

After completing this chapter you should be able to. If only using incremental. Incremental Cost vs.

So take your new sales 95000 and subtract your baseline sales 75000. When making decisions managers should consider all relevant benefits and relevant costs which include. Operating expenses but not capital expenditures.

The result is incremental revenue. If a business is earning. Definition of Incremental Cost.

20000 x 300 6000000. It will cost 50000 to transport and install the machine. An incremental cost is the difference in total costs as the result of a change in some activity.

Calculate the incremental cash flow which is equal to the incremental sales minus incremental operating expenses plus changes in noncash operating expenses. So take your new sales 95000 and subtract your baseline sales 75000. Incremental revenue calculations are derived when evaluating whether to accept an offer from a customer to sell more goods or services usually at a reduced price.

Incremental earnings are the amounts by which a company expects its earnings to change as a consequence of an investment decision -- for example the purchase of a.

Chapter 9 Fundamentals Of Capital Budgeting Chapter Outline 1 The Capital Budgeting Process 2 Forecasting Incremental Earnings 3 Determining Incremental Ppt Download

Incremental Revenue Definition Formula Calculation With Examples

Incremental Irr Analysis Formula Example Calculate Incremental Irr

Fixed Cost Definition Examples Per Unit Formula

Chapter 9 Fundamentals Of Capital Budgeting Chapter Outline The Capital Budgeting Process Forecasting Incremental Earnings Determining Incremental Free Ppt Download

Incremental Costs Factors Influencing Incremental Costs

Fundamentals Of Capital Budgeting Ppt Download

Incremental Cash Flow Meaning Calculation Uses Limitations

The Use Of Cost Information In Management Decision Making Ppt Video Online Download

Incremental Cost Overview Calculation Uses And Benefits

How To Measure Cx Profit Contribution Cx University

Chapter 9 Fundamentals Of Capital Budgeting Chapter Outline The Capital Budgeting Process Forecasting Incremental Earnings Determining Incremental Free Ppt Download

This Course Is Concerned With Making Good Economic Decisions In Engineering Prezentaciya Onlajn

Incremental Cash Flow Definition Formula Calculation Examples

Accounting Rate Of Return Formula Examples With Excel Template

What Is Incremental Sales Definition Formula Pipedrive

Incremental Revenue Definition Formula Calculation With Examples

Comments

Post a Comment